Robinhood trading restrictions for GME and other stocks were bad for customers, the company has admitted. However, CEO Vlad Tenev denied that the company had been pressured into this by hedge fund and business partner Citadel, saying that the company had been left with no choice.

Tenev said that the volume and value of trades meant that its deposit requirements rocketed …

Bloomberg reports:

Robinhood put buying restrictions in place after its clearinghouse deposit requirements for equities increased last week, the company said in a blog post on Friday. “It was not because we wanted to stop people from buying these stocks,” Robinhood said […]

Rumors that the company was pressured by Citadel or other market makers to restrict trading on GameStop and other “meme stocks” are false, Robinhood CEO Vlad Tenev said on social audio app Clubhouse in an appearance with Tesla Inc. Chief Executive Officer Elon Musk. Rather, it was because the National Securities Clearing Corp. sought $3 billion in deposits, which the firm negotiated down to $700 million, he said.

“We knew this was a bad outcome for customers,” Tenev said. “But we had no choice as we had to conform to our requirements.”

The company initially stopped customers buying any of the stocks being pumped by WallStreetBets before allowing “limited” purchases. At one point, it had restrictions on 50 different stocks.

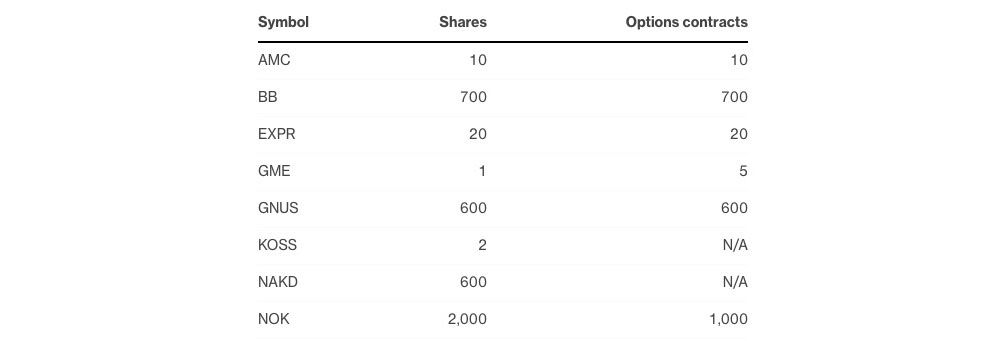

It has now limited restrictions to eight of the stocks, but these mean that customers can only buy a single share of GME, and no more than five options.

The table below shows the maximum number of shares and options contracts to which you can increase your positions. Please note that these are aggregate limits for each security and not per-order limits, and include shares and options contracts that you already hold […]

If you already hold a greater number of shares or contracts than the limits listed above, your positions will not be sold or closed. However, you will not be able to open more positions of each of these securities unless you sell enough of your holdings such that you are below the respective limit.

Robinhood trading restrictions remain subject to change.

App users called on Apple to remove Robinhood from the App Store, which was quickly followed by far bigger problems for the company: threatened regulatory investigations and lawsuits.

Photo by Clay Banks on Unsplash

FTC: We use income earning auto affiliate links. More.

Comments