After years of annual rumors that each successive iPhone would feature NFC, there was understandable skepticism when the rumor rolled around again this year for the iPhone 6. It was looking like Apple might have put all its short-range communication eggs in one basket with Bluetooth LE.

Instead, of course, the iPhone 6 and 6 Plus got NFC as the mechanism for Apple’s contactless payment service, Apple Pay. Pando suggests that the company’s timing may not be entire coincidental.

While U.S. banks have so far ignored the more secure chip-and-pin cards used in Europe, sticking doggedly to magnetic strips and signatures, all that will be changing next year. As of October 2015, banks are switching to chip-based cards – and that means merchants will need to upgrade their payment terminals.

You can still get chip-reading terminals without NFC, but it’s likely that the vast majority of stores will opt to go contactless at the same time. Which means that instead of the 220,000 places you can use contactless payment today, there will be much closer to nine million outlets by this time next year – and you’ll be able to pay with your iPhone 6 at any of them.

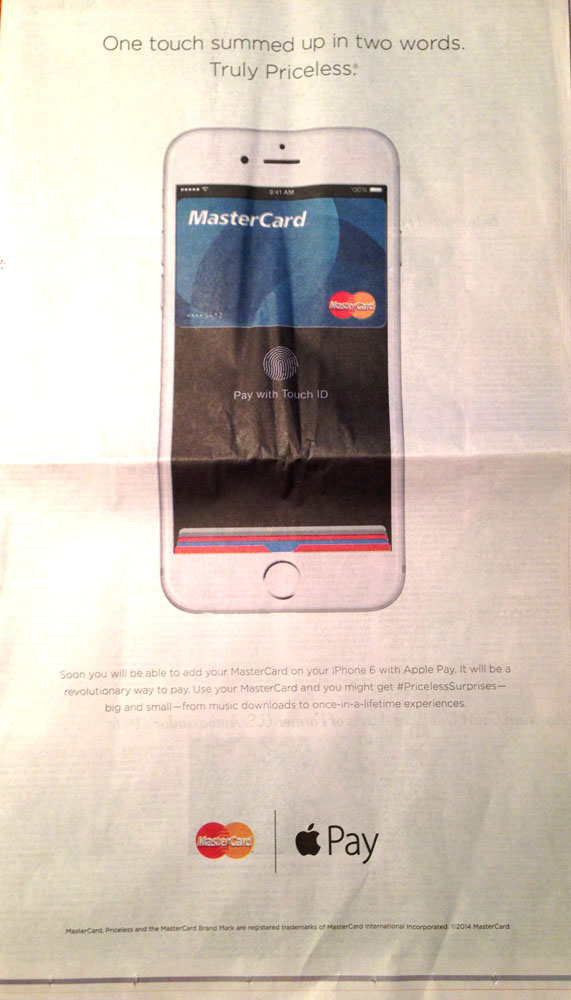

U.S. card issuers are already pushing Apple Pay, MasterCard running a full-page ad in today’s New York Times (via Business Insider).