Wedge Partners analyst Brian Blair has suggested that Apple’s share price could be temporarily depressed by disappointing Q2 results in March before climbing by as much as 20 percent in response to new products in the fall, reports Barrons.

This gap between what is actually happening at Apple and investor sentiment is providing an opportunity for investors. We believe this opportunity should be taken advantage of before Apple’s next array of products hit the market, though the best time to own the stock may be in April after we get the March quarter/June guide behind us.

Blair cites several factors for expecting the stock to take a hit in March when Apple reports its earnings for its Q2 fiscal year (Q1 calendar year). Among them are the general slowdown in the saturated high-end smartphone market, continued soft demand for the iPhone 5c, overly-optimistic market forecasts for China Mobile sales and a reduction in the number of people upgrading their iPhone as they wait for the rumored larger-screen phone(s) in the fall.

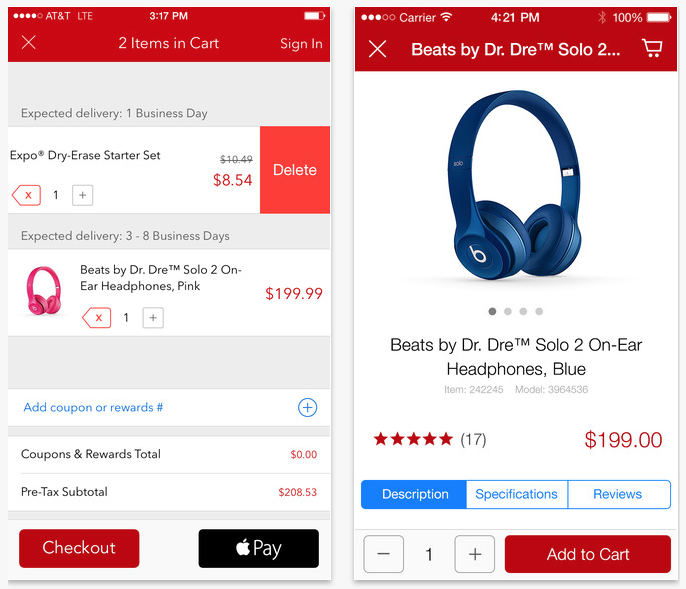

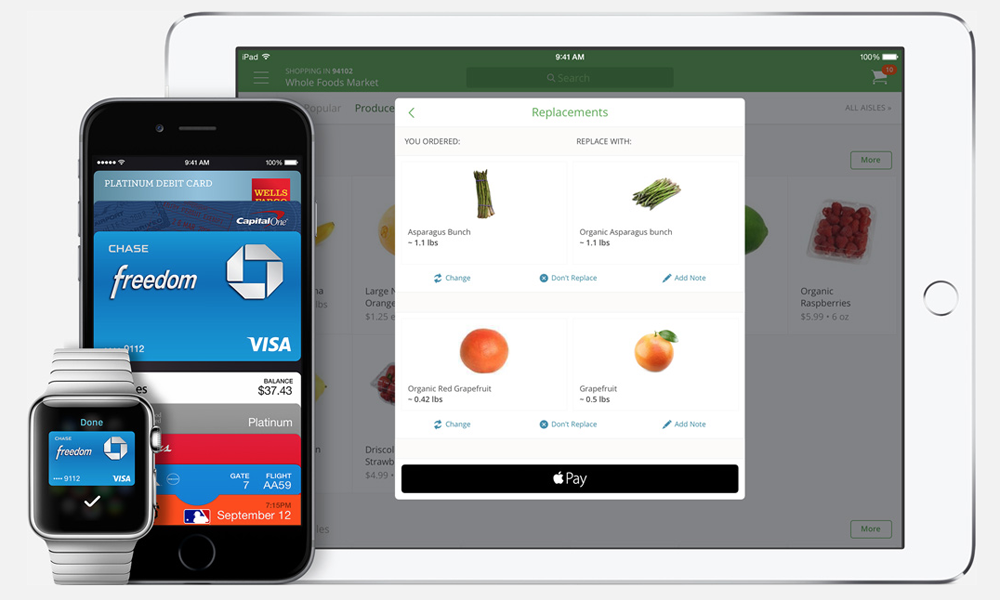

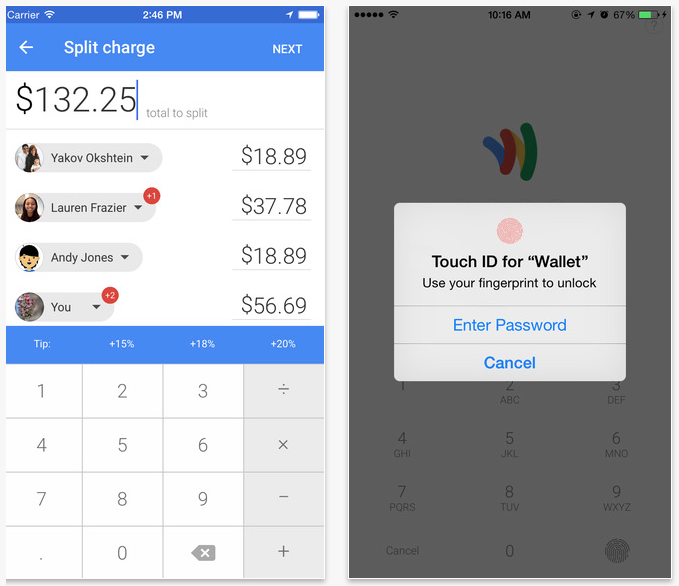

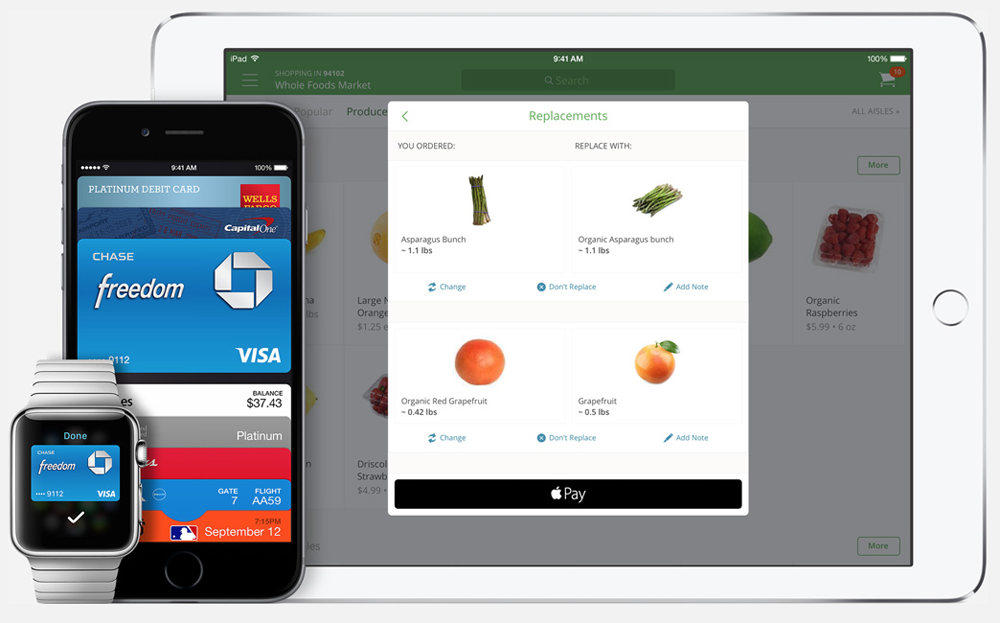

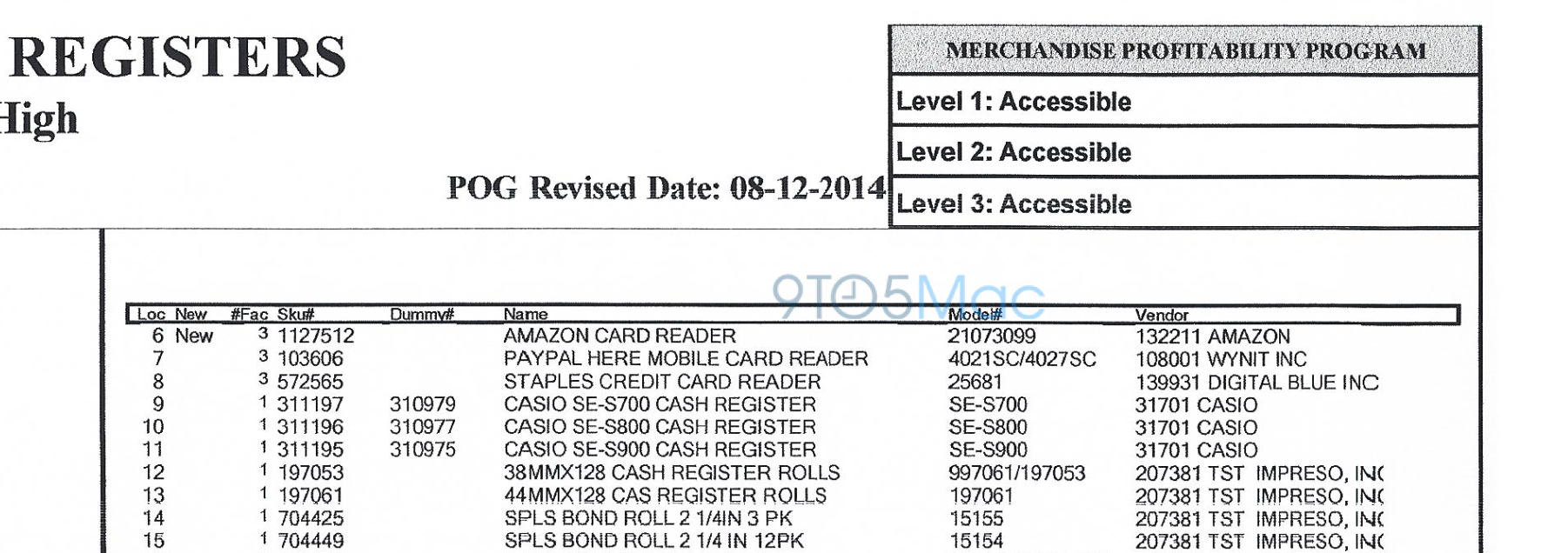

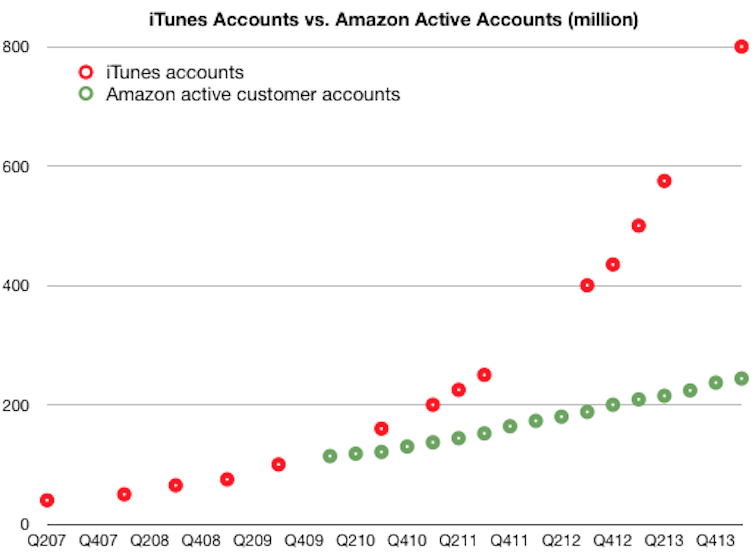

The longer-term outlook is, however, excellent, believes Blair. He expects Touch ID to be rolled out across all iPhones and iPads in readiness for the launch of a mobile payment solution, and he thinks the expected larger iPhone 6 will sell well, especially in Asia.

In terms of completely new products, Blair is predicting the launch of the iWatch in September and a 12-inch display device he expects to see unveiled at WWDC, whether it is the much-rumored iPad Pro or a new 12-inch MacBook Air.

As ever, make your own decisions where investments are concerned …

Via CNET