SEC filings show that Angela Ahrendts had half of her first allocation of AAPL stock withheld on 1st June – the day it vested, and just one month after joining the company – reports ComputerWorld.

According to a filing with the U.S. Securities and Exchange Commission (SEC), Ahrendts received 16,264 shares in Apple stock when it vested June 1 […]

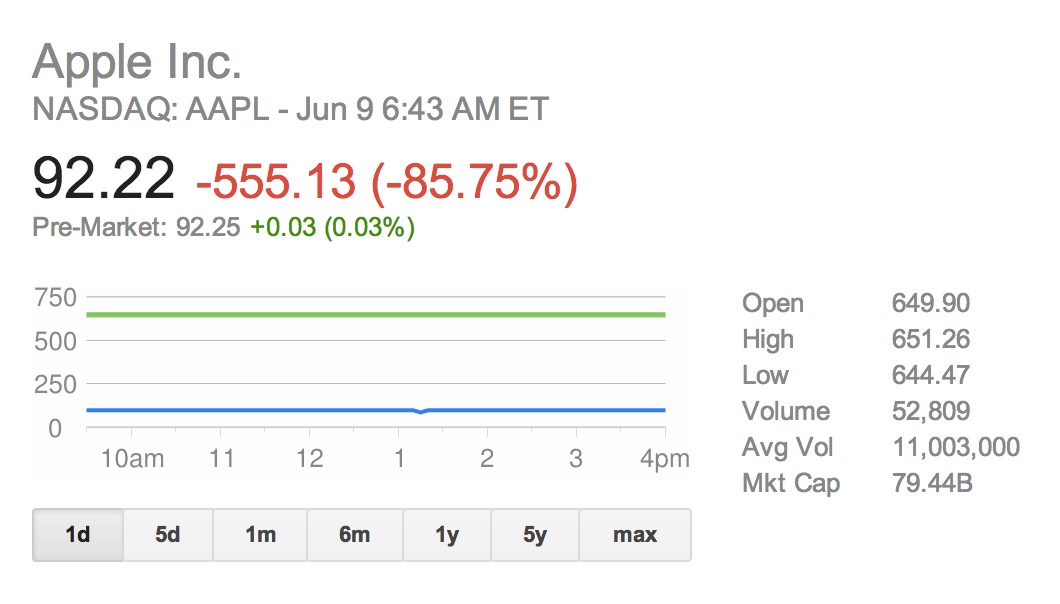

Ahrendts sold 8,331 shares that same day for a pre-tax total of $5,273,523.

The full value of her stock, which is likely to vest (become eligible for sale) over several years, will add up to $78.5M at the current share price. Her total compensation in her final year as CEO of Burberry was $4.4M – though she did also get a clothing allowance of $42,000 and a car allowance of $30,000 (only at a fashion company could you get more to spend on clothes than a car …).

Selling half your stock at the very first opportunity doesn’t seem to send the best of signals a month into the role, but I guess she needs to buy a house out in the Valley and those aren’t exactly cheap right now.

The withholding of the shares came just over a week before a 7-to-1 stock split, on Monday. The stock split should make AAPL shares more attractive to smaller investors, a shift that could make the share price more volatile.

Via Fortune

Update: These shares were withheld for tax purposes by Apple not sold on the open market