When the Apple Card Savings Account launched earlier this year, some users complained that they faced weeks-long delays trying to withdraw their money from their new Goldman Sachs-backed account.

A report today reveals that Apple and Goldman Sachs have now made changes to how these transactions are handled to avoid these types of delays going forward.

Following the initial report from the Wall Street Journal in June, Apple issued a $100 “goodwill” credit to at least some Apple Card Savings Account users. The company also made changes to the fine print to further clarify how deposits and withdrawals are handled through Goldman Sachs.

The Information now reports on a handful of changes Goldman Sachs has made to how it manages Apple Card Savings Account transactions. According to the story, Goldman’s initial system for managing withdrawals was overly sensitive to “potential risky activity” that led to delays, particularly for large withdrawals.

In response to the blowback from users, Goldman Sachs has now “adjusted its approach to cut down the number of, or reduce the severity of, those issues.” The changes, according to today’s report, have already led to a drastic reduction in complaints from users.

The report explains that there is now a cap on how many days a withdrawal should take, as well as new ways of communicating with customers about those delays:

Now, if a customer with a large amount of money tries to move a small portion of their savings to an outside account, the system will be less likely to flag those transactions. Goldman also put in place a cap on the number of days withdrawals should take and prioritized better communication with customers whose transactions were flagged or are experiencing delays, one of the people said.

Goldman Sachs and Apple are also reportedly “emphasizing the option for a three-way-call among the call center and the bank to which the customer is trying to transfer” to help expedite transfers that may get flagged for review.

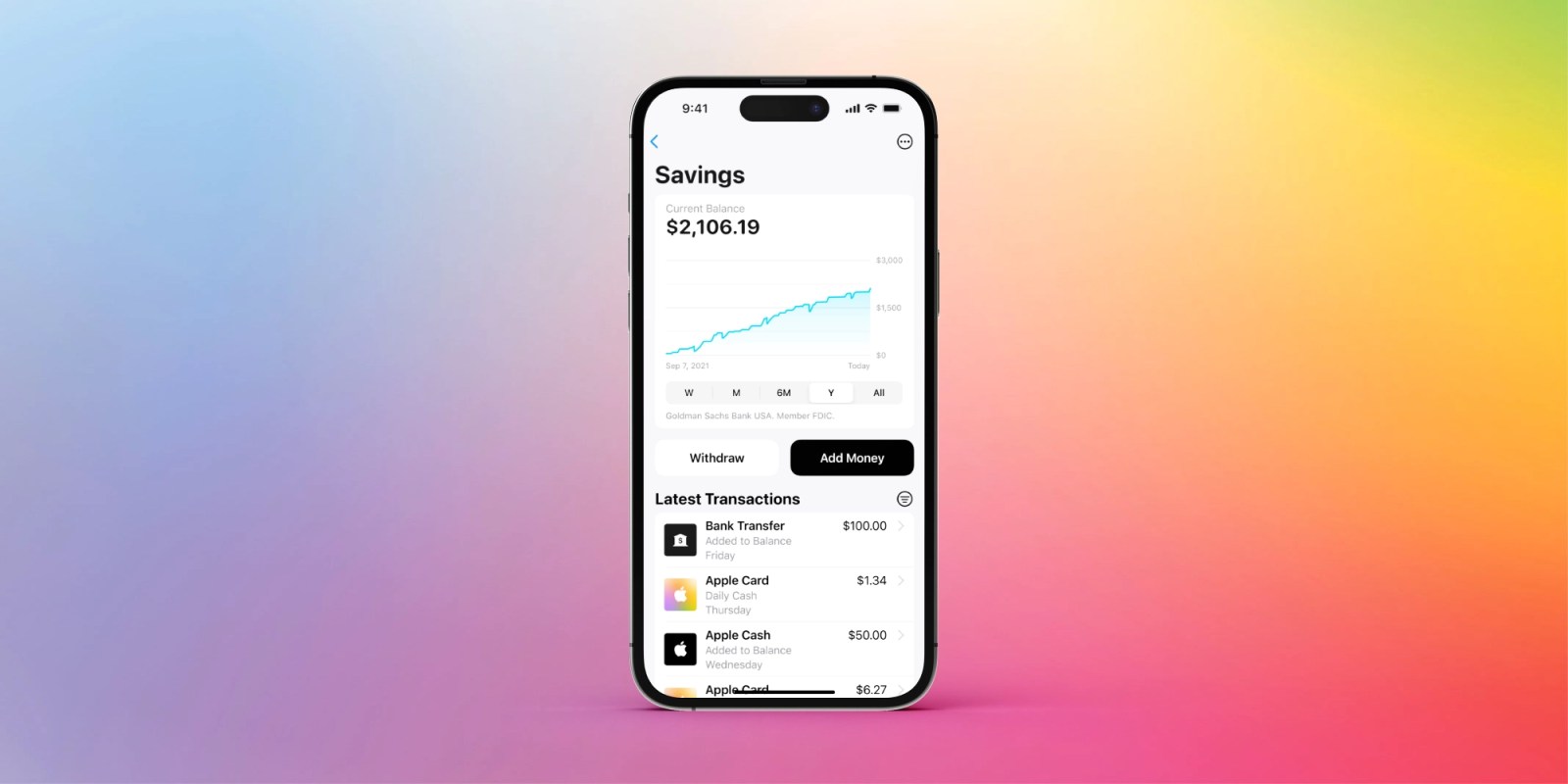

The Apple Card Savings Account launched in April, giving Apple Card users the option to open a dedicated high-yield savings account to earn 4.15% on their money. In August, Apple revealed that the platform has already attracted more than $10 billion in deposits.

Follow Chance: Threads, Twitter, Instagram, and Mastodon.

FTC: We use income earning auto affiliate links. More.

Comments