The Apple Card Savings interest rate has been increased a second time, just two weeks after a previous hike. The annual percentage yield (APY) is now 4.35%.

While there are still better deals out there, Apple does seem to be aiming to remain broadly competitive, as it seeks a new partner bank …

Apple Card Savings interest rate

The Apple Card Savings Account is an option for Apple Card accounts, first introduced in late 2022. Cardholders can opt to have their Daily Cash rewards automatically transferred to a separate savings account, and additional deposits can be made manually.

At the time of launch, the account paid 4.15% APY, which was decent, though falling short of the best deals out there.

A couple of weeks ago, the account got its first ever rate increase, to 4.25%.

Apple announced the boosted interest rate in a push notification sent to Apple Card Savings Account users on Wednesday evening. The 4.25% APY is far better than the industry average, but still less than select other high-yield savings accounts.

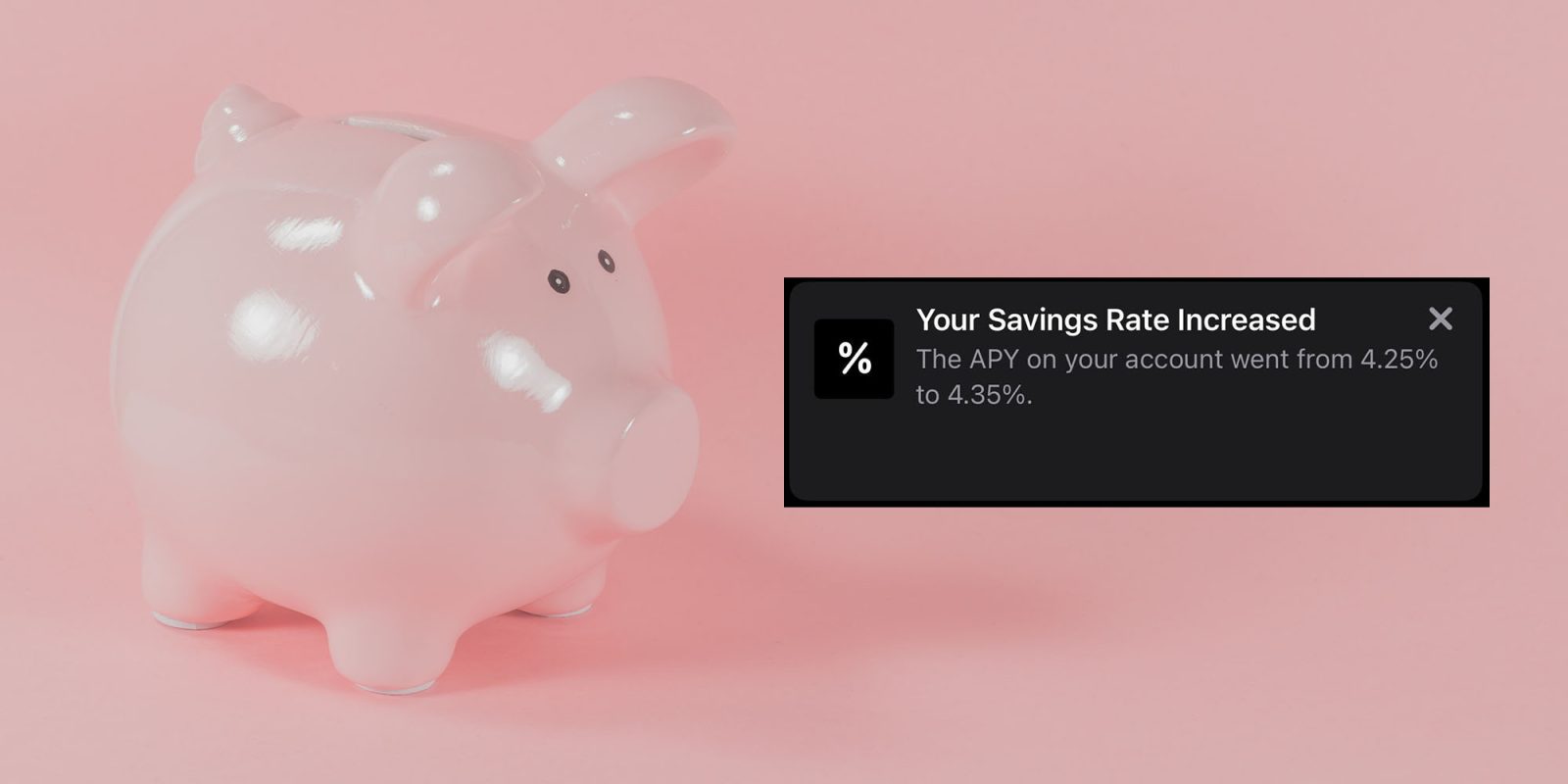

Apple yesterday sent a push notification to account holders, advising that the rate has again been increased.

Your Savings Rate Increased

The APY on your account went from 4.25% to 4.35%.

It’s still the case that you can find better deals – including from current Apple Card partner bank, Goldman Sachs. Its Marcus-branded savings account currently offers 4.5% APY, while PNC offers 4.65% and UFB hits 5.25%.

However, where Apple Card wins is convenience and painless saving. When you make Apple Card purchases, you earn rewards which can be automatically transferred into your savings account, essentially creating a savings pot without any cost or effort.

Understanding APY

The yield of savings accounts is measured by annual percentage yield (APY). This is the effective interest rate you get by putting money into the account and leaving it there, so includes compound interest.

That is, each time interest is added to the account, it applies to the latest account balance – which was increased by the previous interest payments. Here’s an example provided by Investopedia:

Imagine investing $1,000 at 6% compounded monthly. At the start of your investment, you have $1,000. After one month, your investment will have earned one month’s worth of interest at 6%. Your investment will now be worth $1,005 ($1,000 * (1 + .06/12)). At this point, we have not yet seen compounding interest.

After the second month, your investment will have earned a second month of interest at 6%. However, this interest is earned on both your initial investment as well as your $5 interest earned last month. Therefore, your return this month will be greater than last month because your investment basis will be higher. Your investment will now be worth $1,010.03 ($1,005 * (1 + .06/12)). Notice that the interest earned this second month is $5.03, which is different from the $5.00 from last month.

After the third month, your investment will earn interest on the $1,000, the $5.00 earned from the first month, and the $5.03 earned from the second month. This demonstrates the concept of compound interest: the monthly amount earned will continually increase as long as the APY doesn’t decrease and the investment principal is not reduced.

The APY is a simple way to understand the overall return achieved.

Photo by Pawel Czerwinski on Unsplash

FTC: We use income earning auto affiliate links. More.

Comments