Apple publishes recommendations on tax reform ahead of Senate hearing on offshore tax practice

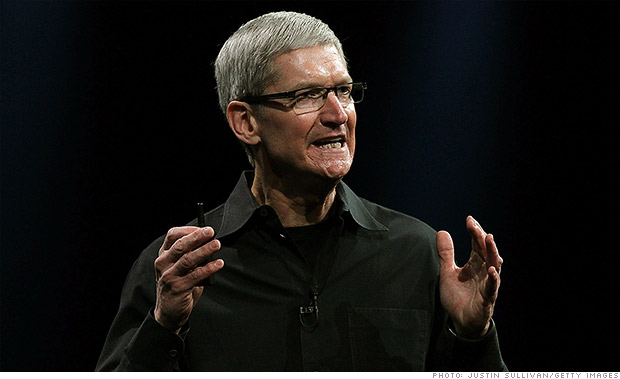

Apple today has published its testimony proposing corporate tax reform and detailing the company’s tax practices ahead of CEO Tim Cook’s appearance at a Senate hearing on offshore tax practices scheduled for tomorrow.

In the testimony, Apple proposed what it called comprehensive corporate tax reform that should: Be revenue neutral, eliminate all corporate tax expenditures, lower corporate income tax rates; and implement a reasonable tax on foreign earnings that allows free movement of capital back to the US.

While some Subcommittee members may have differing views on these tax policy matters, Apple hopes the Subcommittee will see that these recommendations aim to create meaningful change and go well beyond what most US companies propose. As both a pioneer and participant in the American innovation economy, Apple looks forward to working with the Subcommittee on its efforts to encourage comprehensive reform of the US corporate tax system. Apple appreciates the opportunity to appear before the Subcommittee to contribute constructively to this important debate.

Apple also detailed the company’s current tax practices and noted it “made income tax payments to the US Treasury totaling nearly $6 billion – or $16 million per day.” Apple points out that, at a rate of 30.5%, that accounts for around “$1 out of every $40 of corporate income taxes collected by the US Treasury last year.”

Apple continued by commenting on its recent decision to borrow $17 billion in debt instead of repatriating offshore funds to help fund its shareholder return:

Expand

Expanding

Close