Apple Wallet account balances can now be viewed for a total of 10 UK banks and card companies, as Apple continues the rollout of the new feature.

Users can follow a short process to connect the app to their bank account, and it will then show the current account balance directly underneath the card itself …

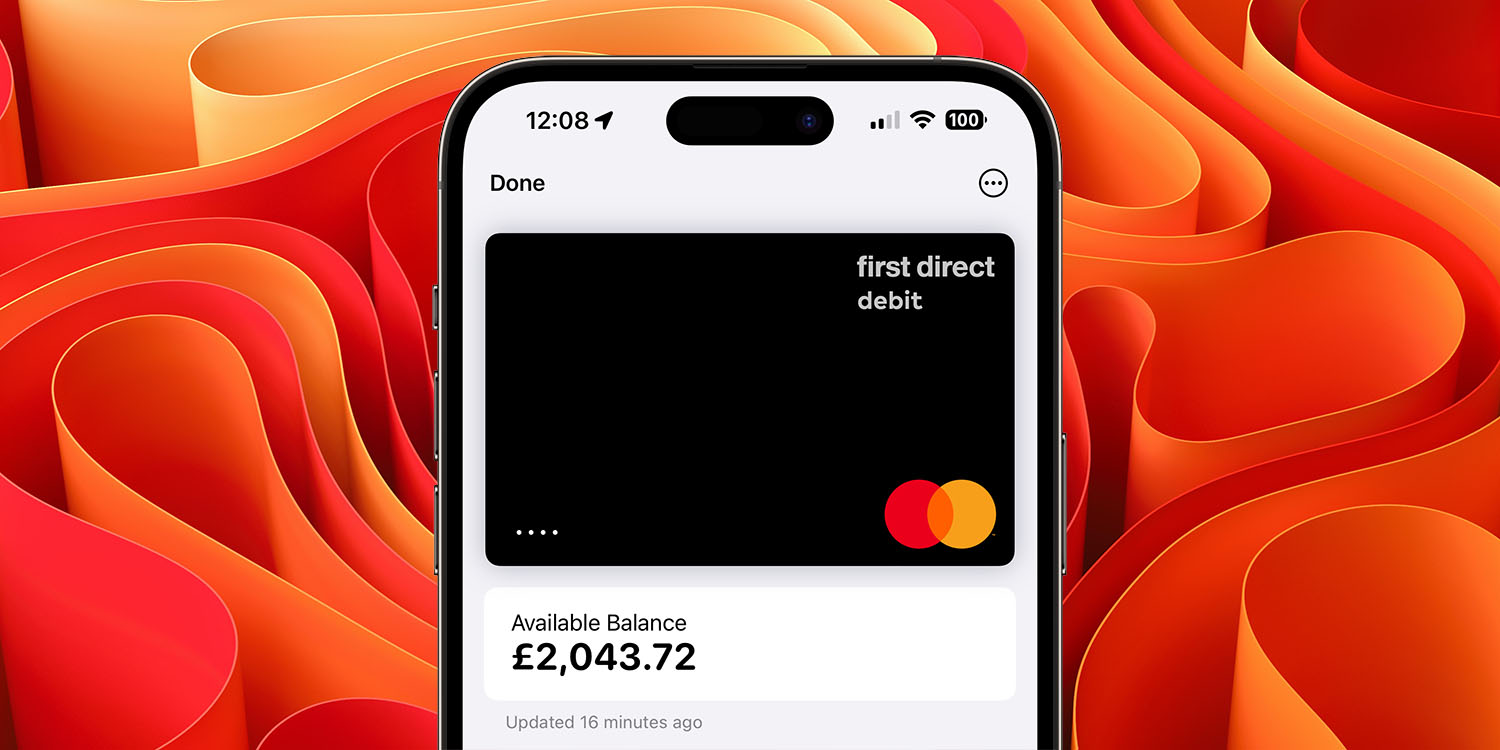

Apple Wallet account balances

Once you’ve completed the setup process for the feature, a new field appears below the card reading Available Balance. That balance is regularly updated to help users keep track of their spending.

The feature was first seen in the developer beta of iOS 17.1, when it was limited to six banks. More banks and card companies are now supporting the feature:

- Barclays

- Barclaycard

- First Direct

- Halifax

- HSBC

- Lloyds

- M&S Bank

- Monzo Bank

- NatWest Bank

- Royal Bank of Scotland

You will also be able to view your full transaction history, not just purchases made using Apple Pay.

Setup process

- Open the Wallet app

- Tap the card you want to connect

When one of your cards supports the feature, you’ll see a box beneath the card headed ‘See Balances and Full Transaction History for This Account.’

- Tap Get Started

- Tap Continue

The Wallet app needs to be authorised by your bank, so will open your banking app, which will ask you to select the account(s) you want to link. Once you’ve done this, you’ll be returned to the Wallet app, and your balance and full transaction history will be shown.

Security and privacy

The law sets out strict privacy and security standards which have to be met.

In the case of the Wallet app, data is securely sent directly from your bank to your device – it does not go via any third-party servers, so Apple cannot access either your account balance or your transaction history.

Why isn’t this available in the US?

Most new Apple features launch first in the US, but this particular one relies on a UK law requiring banks to provide something known as Open Banking.

Open Banking has three components:

- An API allowing third-party apps to access real-time account information

- A more efficient way to make payments

- More accurate credit scores through access to live financial data

Customers can, for example, use a single third-party app to view account balances and statements from their accounts with multiple banks. This is the API used by the Wallet app.

Open Banking is also part of EU law, so it is likely that the feature will rollout to other European countries soon – alongside more UK banks.

While there is some industry support for Open Banking within the US, there is currently no legislation to require its adoption, so it’s likely to be quite some time before it is available in America.

FTC: We use income earning auto affiliate links. More.

Comments